|

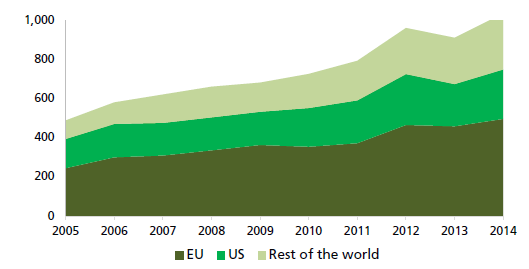

By Prof. Nigel Driffield, Warwick Business School Inward investment is of vital importance to the UK economy. Compared to other G7 countries, the UK has had the highest percentage of inward FDI as a percentage of GDP, at 64 per cent of GDP in 2014 (ONS 2016). Much of this investment is from other EU member states, as Figure1 shows.

How is inward investment likely to be affected by the UK leaving the European Union? Investors in the UK will face a number of challenges as a result of Brexit if they seek to sell into the EU and operate supply chains that cross between the UK and the UK. The devaluation in sterling will also have an impact on inward investment decisions. There will be challenges for investors if they seek to operate supply chains that cross (sometimes several times) between the UK and EU. When the single market was created in 1993, many commentators speculated that intra-EU FDI would plummet. This turned out to be far from the case as firms took advantage of the opportunities to coordinate resources across countries. The single market connects innovative firms to the richest market in the world and, through EU regional policy and structural funds, allows firms to take full advantage of location economies where labour is available in low-cost locations. Most recently, Honda has warned MPs of the consequences of leaving the customs union. From an inward investment perspective the essential problem is that the ‘middle region’ of activities of the value chain, characterised by lower value added and higher volume of employment, are often carried out outside the UK. Developed countries attempt to “plug the gap in the middle” by seeking inward investment that will generate employment for the squeezed middle. This can be achieved by identifying key sectors that hit the ‘sweet spot’ of high productivity but also employment generation. However, these sectors, such as advanced manufacturing, food technology and financial services, are the ones most vulnerable to frictions in value chains which drive away investment, due to the way they are organised in the single market.

2 Comments

|

Authors

Scholars from the field of International Business and other related disciplines Archives

April 2023

Categories |

Support |

© COPYRIGHT 2021. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed